In News:

- Recently, the Reserve Bank of India (RBI) released its biannual Financial Stability Report.

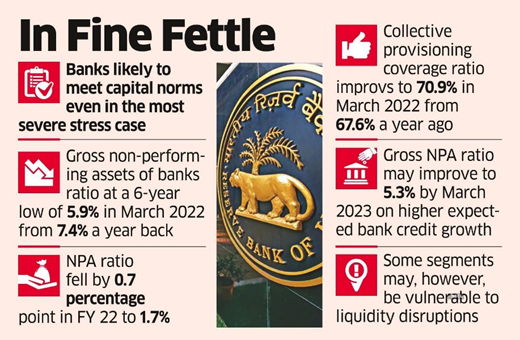

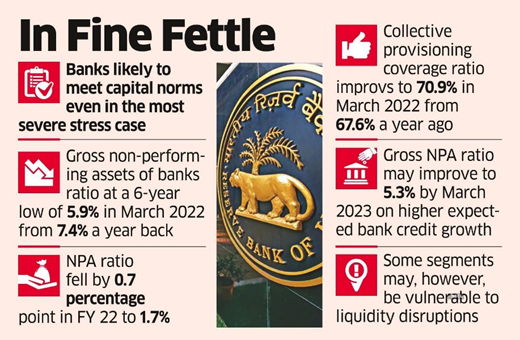

- As per the report, asset quality of the banking system has improved.

- Gross Non-Performing Assets (GNPA) ratio declined from 7.4 per cent in March 2021 to a six-year low of 5.9 per cent in March 2022.

What’s in today’s Article:

- About FSR (Purpose, Components, Significance, etc.)

- Key takeaways from latest FSR

Financial Stability Report:

- Financial Stability Report is released by the RBI twice a year.

- The report details the state of financial stability in the country.

- As part of the FSR, the RBI also conducts a Systemic Risk Survey (SRS), wherein it assess the financial system on five different types of risks:

- Global; Financial; Macroeconomic; Institutional; General.

Significance of FSR:

- Reading the FSR tells us how robust or vulnerable our financial system — especially our banking system — is to the changes in the economy.

- As a corollary, it also tells us whether and to what extent will our banks and other lending institutions (such as Non-Banking Finance Companies and Housing Finances Companies) be able to support future growth.

- For instance, if the FSR reveals that the percentage of NPAs or bad loans in the banking system is high and also shows that the government fiscal deficit is also high.

- Then it means that not only will the banks struggle to function effectively (and fund future growth) but also that if banks were to falter then the government may find it tough to bail them out.

Key takeaways from the latest FSR:

- Indian economy:

- The Indian economy remains on the path of recovery, though inflationary pressures, external spill overs and geopolitical risks warrant careful handling and close monitoring.

- The external sector is well-buffered to withstand the ongoing terms of trade shocks and portfolio outflows.

- Asset quality of Banks:

- Asset quality of banks improved steadily throughout the year, with gross NPA ratio declining to a six-year low of 5.9% in March 2022 from 7.4% in 2021.

- NPA is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

- The banking stability indicators showed improvement in soundness, efficiency and market risk dimensions in the second half of FY22.

- Stock market:

- The number of demat accounts of individuals increased 3.4 times on CDSL and 1.5 times on NSDL since January 2020.

- 'CDSL' is short for 'Central Depository Securities Limited' while 'NSDL' is short for 'National Securities Depository Limited’.

- Both CDSL and NSDL are depositories registered by the Indian government to hold multiple forms of securities like stocks, bonds, ETFs, and more as electronic copies.

- However, the report suggested that the developments in 2022 have unsettled the market sentiment and increased risk aversion.

- Fintech industry:

- The Indian fintech industry — which is amongst the fastest growing Fintech markets in the world — was valued at $50-60 billion in 2020 and is projected to reach $150 billion by 2025.

- Cautioning about the financial technology (fintech) industry, the FSR said the advent of fintechs has exposed the banking system to new risks.

- These risks extend beyond prudential issues and often intersect with other public policy objectives relating to safeguarding of data privacy, consumer protection, etc.

- Cryptocurrencies:

- While technology has supported the reach of the financial sector and its benefits must be fully harnessed, its potential to disrupt financial stability has to be guarded against.

- The report has flagged cryptocurrencies as a clear danger among the emerging risks on the horizon.

- The report highlights that anything that derives value based on make believe, without any underlying, is just speculation under a sophisticated name.